Is It Safe to Buy Stocks With the S&P 500 Near Its Record High? Here's Warren Buffett's Investing Advice

The Motley Fool

FEBRUARY 25, 2024

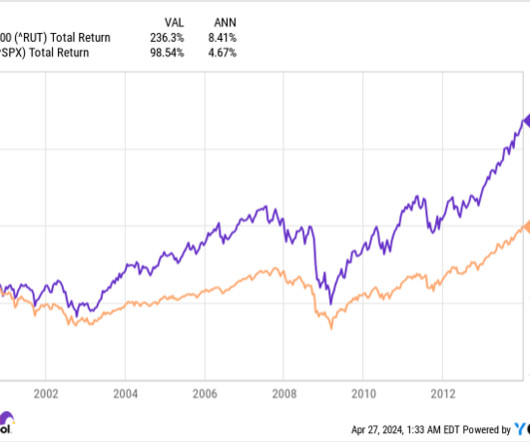

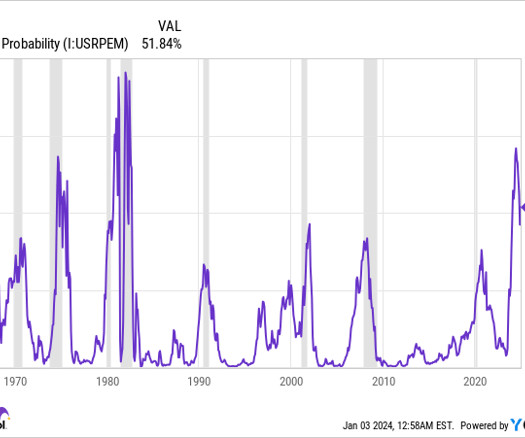

The S&P 500 (SNPINDEX: ^GSPC) soared 24% in 2023, and investors have bid the benchmark index to multiple record highs this year. That widely quoted advice calls attention to a quirk of human nature. To quote Buffett, "If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes."

Let's personalize your content